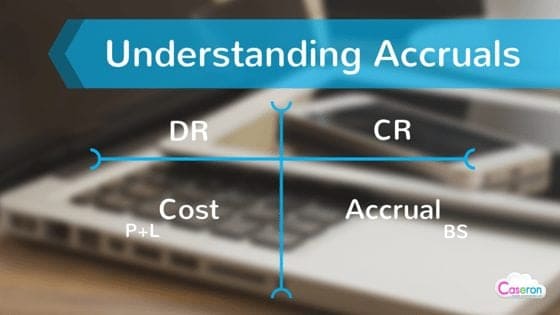

The types of accounts to which this rule applies are liabilities, revenues, and equity. If a company renders a service and gives the customer/client 30 days to pay, the company’s Accounts Receivable and Service Revenues accounts are both affected. For each transaction mentioned, one account will be credited and one will be debited for the transaction to be in balance.

Credit card law would give big-box stores payday at community’s … – Colorado Newsline

Credit card law would give big-box stores payday at community’s ….

Posted: Mon, 21 Aug 2023 07:00:00 GMT [source]

And when you record said transactions, credits and debits come into play. So, what is the difference between debit and credit in accounting? For example, an allowance for uncollectable accounts offsets the asset accounts receivable. Because the allowance is a negative asset, a debit actually decreases the allowance. A contra asset’s debit is the opposite of a normal account’s debit, which increases the asset.

Are Debits and Credits Used in a Single Entry System?

The exceptions to this rule are the accounts Sales Returns, Sales Allowances, and Sales Discounts—these accounts have debit balances because they are reductions to sales. Accounts with balances that are the opposite of the normal balance are called contra accounts; hence contra revenue accounts will have debit balances. Properly establishing your chart of accounts in accounting software, and diligently noting which account a debit or credit belongs to, enables the program to apply the debits and credits properly.

Remember that debits are always recorded on the left with credits on the right. A transaction that increases your revenue, for example, would be documented as a credit to that particular revenue/income account. Debits and credits form the basis of the double-entry accounting system of a business. Debits represent money that is paid out of an account and credits represent money that is paid into an account. Each financial transaction made by a business firm must have at least one debit and credit recorded to the business’s accounting ledger in equal, but opposite, amounts. On the other hand, when a utility customer pays a bill or the utility corrects an overcharge, the customer’s account is credited.

Is an Expense a Debit or Credit in a Journal Entry?

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance a guide to nonprofit accounting for non and investing, and real estate. First Republic and its affiliates do not provide tax or legal information or advice. Delivering a personal approach to banking, we strive to identify financial solutions to fit your individual needs.

- The complete accounting equation based on the modern approach is very easy to remember if you focus on Assets, Expenses, Costs, Dividends (highlighted in chart).

- When using T-accounts, a debit is on the left side of the chart while a credit is on the right side.

- All those account types increase with debits or left side entries.

- Companies break down their expenses and revenues in their income statements.

- This debit shows that your expense account has increased—or the transaction has increased your total costs.

Depreciation is an accounting tool businesses use to record the loss in value of physical assets (like vehicles or machinery) over time. It’s recorded on financial reporting documents, like balance sheets and income statements. The transactions summarized by an account in the trial balance should be the same as those summarized by an account in the general ledger. Before closing the books, accountants generate a trial balance which lists accounts in numerical order with debit and credit accounts balances. If the debits equal the credits on a trial balance, then the next step is to create the general ledger for each company. Assets and expenses have natural debit balances, while liabilities and revenues have natural credit balances.

What is an expense in accounting?

Here’s one example of preparing a journal entry for your payroll expenses. In that case, you can use accrued expenses (also known as accrued liabilities) to record unpaid expenditures that you have to estimate, such as your utilities or income taxes. By maintaining records of your expenses, you can better understand the cost of running your business and calculate your profits.

For example, the money a company spends on purchasing a van is ‘cost’ whereas the cost of buying petrol and servicing the van are expenses. Therefore, all expenses can be considered as costs, but not all costs are necessary expenses. However, even though the accounting system is referred to as double-entry, a transaction may involve more than two accounts. A company’s loan payment to its bank is a typical example of a transaction that involves three accounts. This transaction will involve the Cash accounts, Notes Payable accounts, and Interest Expense accounts.

Examples of Post-Closing Entries in Accounting

Depending on how you categorize your expenses – under which accounts – you can better understand where your money goes and make informed decisions about future investments or cost-cutting measures. The below example illustrates a financial transaction in which a catering company provided its services for a client’s party. In this case, the client didn’t immediately pay in full; rather, they asked to be billed.

He knows that he has a specific amount of actual cash on hand, with the exact amount of debt and payables he has to fulfill. Today, most bookkeepers and business owners use accounting software to record debits and credits. However, back when people kept their accounting records in paper ledgers, they would write out transactions, always placing debits on the left and credits on the right.

The Differences Between Debit & Credit in Accounting

This is a type of temporary account that is zeroed out at the end of the fiscal year. It is zeroed at the end of the year in order to make room for the recordation of a new set of expenses in the next fiscal year. Debits and credits come into play on several important financial statements that you need to be familiar with. It’s important to note that once you’ve decided on an accounting method, consistency is key in order to maintain accuracy in reporting financial information. Keeping detailed records can also aid in ensuring proper implementation of the chosen accounting method. Consider factors such as business size, industry-specific requirements, tax implications and growth potential when choosing an accounting method.

- In simple terms, an expense account is like a ledger that records your company’s spending.

- Travel expenses may be broken into separate accounts like airfare, hotels, and travel meals if separate tracking is desired.

- Depreciation is an accounting tool businesses use to record the loss in value of physical assets (like vehicles or machinery) over time.

- For example, the money a company spends on purchasing a van is ‘cost’ whereas the cost of buying petrol and servicing the van are expenses.

For example, if you’re paying for office supplies using cash from your bank account, then you would debit the office supply expense account and credit the bank account. When it comes to accounting, one of the most common questions that business owners ask is whether an expense account should be debited or credited. In order to answer this question, it’s important to understand what each term means.